Thud!

Or was it “squish”?

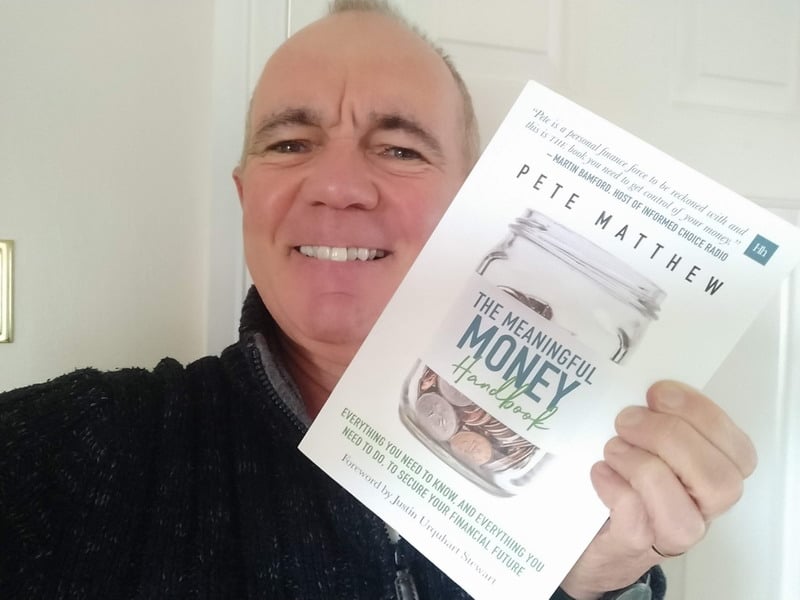

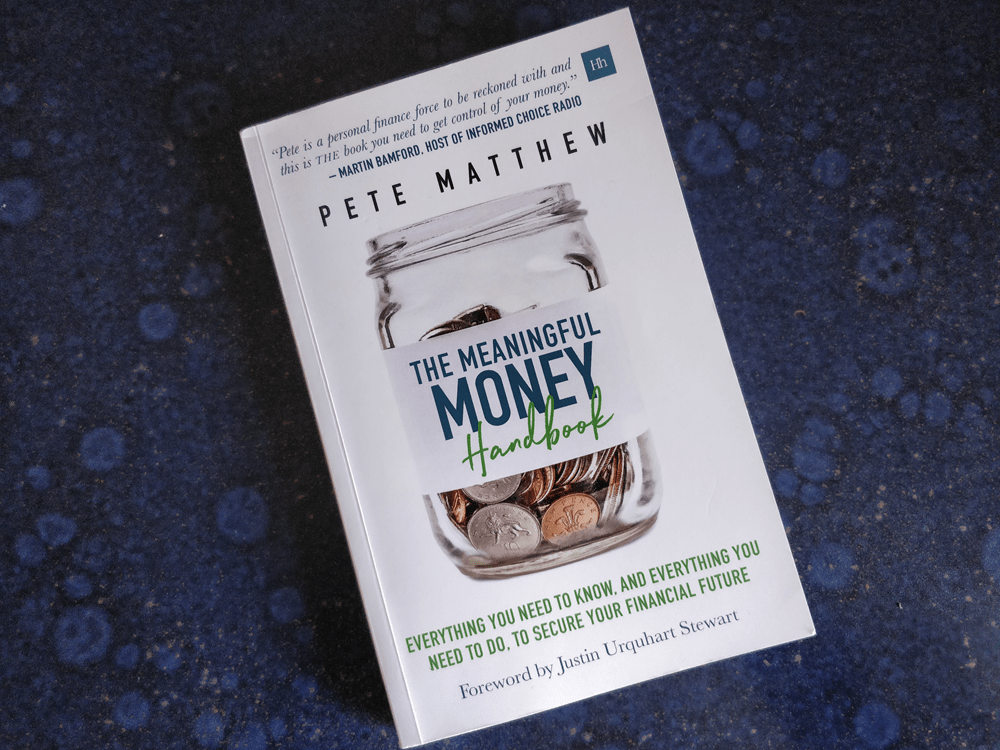

My copy of The Meaningful Money Handbook dropped through the letterbox in a soaked Jiffy bag on a stormy September morning.

Thankfully, the Jiffy-bag was well sealed and my book was dry.

I’d been looking forward to reading this.

After all, I’d eagerly listened to every single episode of Pete Matthew’s Meaningful Money podcast. And this book promised to be the culmination of all that practical personal-finance information.

So would I be delighted or disappointed?

Well, here’s what I found…

The Meaningful Handbook can be distilled into its author’s mantra, which is…

The 3 Things Pete Matthew Constantly Preaches

You’ll often hear Pete Matthew say on his podcast…

- Spend less than you earn

- Protect against disaster

- Save, and invest wisely

So there you have it… You don’t need to read the book now! Go and have a brew instead.

My Financial Disaster Averted

Thankfully, I’d always tried to follow that step 1: “Spend less than you earn”. So, apart from our mortgage (and the rare car loan when it was advantageous to us), my wife and I have managed to avoid any debt. We’ve saved up for anything we’ve needed.

Even through those expensive years of raising children on one salary, we did without some things so that we could build a small emergency fund and stay out of debt. And, oh boy, were we glad we’d done that when I got made redundant. It kept us out of trouble, kept a roof over our young family’s heads, and continued to provide us with food on the table.

So immediately I could agree with Pete’s first guideline. And the saving bit, too.

But What If You Are In Debt?

If you have debt, Pete has a wonderfully practical section in the book to show you what to do to get out of debt and begin to get on a good financial footing.

Protect Against Disaster

You’d think “protecting against disaster” refers to buying some home insurance. Well, that’s obvious – we need to do it. And, of course, you don’t need a book for that.

However, the Meaningful Money Handbook also looks at the other things that are important at various stages of life – such as life assurance, wills, power of attorney, critical illness, income protection… and just as importantly, who needs them, why, how much, when, and how to go about getting them.

It’s about protecting what’s important to us.

That’s what I really like about this book… it’s practical. Extremely practical.

Isn’t Investing Only For The Rich?

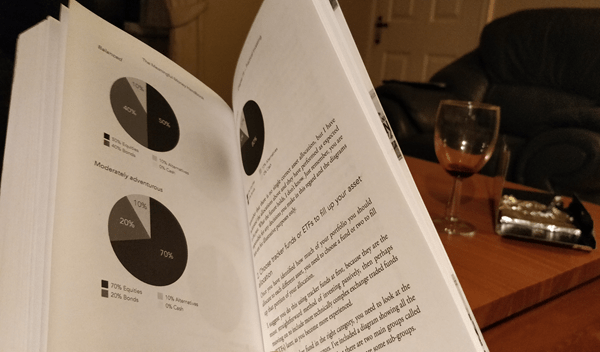

Nope, not at all. If you pay into a works pension, you’ll probably be doing some investing – or someone will be doing it for you. Same with a stocks and shares ISA. Pete shows us how to do the investing ourselves… so that your hard earned money can work hard for you.

Hey, believe me, it’s much more fun being in charge of your own pension fund, watching it grow, and looking forward to retiring earlier than the Government says you can.

Been there. Done that. Bought the T-shirt. Yup – I took early retirement at age 57. How? Because we had kept to the sort of principles Pete talks about in this book. So yes, it can be done!

Pete makes the topic of investing understandable and interesting. And he tells you how to do it.

That’s a skill in itself: making investing interesting.

So whether you want to be hands-off or hands-on with your investments, there’s a section there for you.

Anything I didn’t like?

I did find the beginning a bit simplistic. But that’s great – because it’s perfectly suited for you if you’re just starting out on your financial journey. And like a good film, the book builds on its foundations; I found each successive chapter more and more interesting and useful.

Was it worth the money?

Absolutely. It’s the best personal finance book I’ve read.

Why do you say that, David?

Because it covers everything you need to know and everything you need to do to secure your financial future. Now where have I heard that phrase before…? Ah yes, I remember… Pete Matthew, the author, says it. But having read every word in the book, I have to agree. It’s practical.

Who’s It Really For?

The Meaningful Money Handbook seems to be aimed at people who want to take control of their own financial future. It lays out a clear path to help you do that, explaining what to do, how to do it, and giving you all the necessary insights. It leaves out any financial mumbo-jumbo. So it’s definitely not for the professional investor. If you want to plan for a secure financial future, I’d recommend it.

I bought my book from Blackwells because they accepted the book token I’d received at Christmas. And I wanted a hard copy rather than the Amazon Kindle books I normally buy (hey, Kindle books are cheaper – and isn’t that what good money-management is about?).

Whether you want the hard copy or the Kindle version, you can grab them here on Amazon…

The Meaningful Money Handbook (hard copy)

The Kindle Version

Your Views

If you’ve read The Meaningful Money Handbook yourself, I’d love to know what you thought of it and if you got any particular benefits from it – and I’m sure other blog readers would like to know too. You can share your thoughts by popping a comment into the box below.

Here’s to a successful financial future.

Normally I cover my ears when finances are concerned, I hate talking about money – wrong attitude I know! You have summarised the book to make me believe I might enjoy reading it and perhaps get to grips with my ‘financial future’; I am going to buy it – you better be able to run fast if your wrong 🙂

Thanks for your kind comments and helpful feedback, Kat. Glad my review was useful. From what you say, I think you’ll enjoy reading the book – and I’m confident I won’t need to invest in some new running shoes. 😉